ICI: Prime Money Market Funds Didn’t Trigger Financial Turmoil in March

New Paper Shows How Stress in Fixed-Income Markets and Some SEC Reforms Fed into Redemption Pressure

Washington, DC; November 5, 2020—There were serious and widespread dislocations in short-term credit and other fixed-income markets before institutional prime money market funds experienced redemption pressure, and some Securities and Exchange Commission (SEC) reforms exacerbated—rather than mitigated—that pressure, according to “Experiences of US Money Market Funds During the COVID-19 Crisis,” a new paper from the Investment Company Institute (ICI).

“Money market funds did not trigger the turmoil that struck fixed-income markets in March,” said ICI President and CEO Paul Schott Stevens. “Though the SEC’s 2010 and 2014 reforms resulted in a much more resilient money market fund sector, one of the principal 2014 reforms, which gave fund boards the option to impose liquidity fees and gates if a fund dipped below the 30 percent weekly liquid assets threshold, may have intensified flows from institutional prime money market funds instead of moderating them.”

Stress in Short-Term Markets Didn’t Originate with Prime Money Market Funds

Assertions that institutional prime money market funds caused the financial turmoil in March are inconsistent with the data, explains ICI. For example, as this paper and previous papers demonstrate, many different markets experienced dislocations, including markets for Treasury bonds, longer-term agency securities, municipal securities, corporate bonds, and foreign exchange—markets in which prime money market funds are not significant players. The report also analyzes the sequence of events that occurred during the COVID-19-related volatility to help assess causality. Importantly, stresses appeared in many of those markets several days before institutional prime money market funds began to see meaningful outflows. Consistent with this timing, the paper shows that media reports were replete with mentions of the Treasury markets during the first three weeks of March, but money market funds were seldom mentioned until March 19—the day after the Federal Reserve established the Money Market Liquidity Facility (pages 14–16).

Prime Money Market Funds’ Experiences Differed from the 2007–2009 Global Financial Crisis

Though money market funds’ experiences during the COVID-19 and global financial crises share some similarities, ICI’s paper shows that their differences were significant. Importantly, during March 2020, prime money markets funds were much more liquid than they were in 2007–2009 as a result of the SEC’s 2010 and 2014 reforms. From 2007 to 2009, 33 percent of institutional prime money market fund assets, on average, were in weekly liquid assets; that rose to an average of 43 percent from 2010 to June 2020. For retail prime funds, the increase in the proportion of their assets in weekly liquid assets was even more substantial, rising from an average of 27 percent from 2007 to 2009 to 41 percent from 2010 to June 2020 (pages 22–24).

ICI’s paper also details other differences, including that prime money market funds:

- saw smaller outflows in terms of dollars (page 24);

- rolled off more repurchase agreements to meet redemptions (pages 26–27); and

- made less use of Federal Reserve liquidity facilities during the COVID-19 crisis (pages 25–26).

In part, these differences reflected the successful elements of the SEC’s 2010 and 2014 reforms that made money market funds more resilient, such as requirements for enhanced credit quality, shorter portfolio maturities, and minimum liquidity levels.

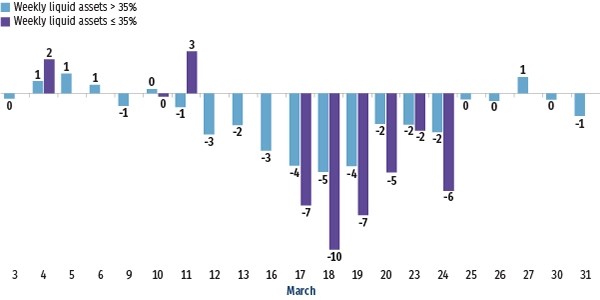

Potential Liquidity Fees and Gates Intensified Redemption Pressure

The SEC’s 2014 money market reforms imposed significant changes on money market funds, including giving prime and tax-exempt fund boards the option to impose liquidity fees and gates if a fund’s weekly liquid assets dip below the 30 percent regulatory requirement. This was meant to allow boards to have greater flexibility to determine the best line of defense against heavy redemptions. ICI’s paper, however, shows that the potential for liquidity fees and gates may have accelerated redemptions. As the figure below illustrates, from March 17 to March 24, outflows were much stronger from institutional prime money market funds with weekly liquid assets at or below 35 percent, even though these funds held liquid assets above the required minimum.

As Weekly Liquid Assets Dropped Below 35 Percent, Institutional Prime Money Market Funds Had Larger Outflows

Average percent change in assets of prime funds, daily, March 3–March 31, 2020

Source: ICI calculations of Crane data

Given uncertainty about how a fund’s board might act if the fund reached the regulatory minimum, some institutional investors treated the 30 percent limit as one to be avoided instead of a significant liquidity cushion (pages 30–37).

Money Market Funds Made Limited Use of Liquidity Facility

The Federal Reserve established several liquidity facilities to support households, businesses, and the US economy overall, including the Money Market Mutual Fund Liquidity Facility (MMLF). ICI’s paper explains that these various facilities were both necessary and appropriate to helping restore liquidity and the flow of credit to the economy. As the paper discusses, the MMLF helped institutional prime money market funds meet their investors’ demands for liquidity and helped stabilize the supply of liquidity to financial firms that borrow through short-term credit markets (pages 37–40). That said, prime money market funds’ use of the facility was much more limited than their use of a similar facility in 2008—$53 billion in 2020 compared to $152 billion in 2008 (pages 25–26, 37–38).

Report Overseen by ICI’s COVID-19 Working Group

This paper is the third in ICI’s series, Report of the COVID-19 Market Impact Working Group. The report is being issued under the auspices of ICI’s COVID-19 Market Impact Working Group, whose members include senior industry executives convened by the Executive Committee of ICI’s Board of Governors for this purpose. The working group is examining the causes of the market turmoil in early 2020 and the experiences of regulated funds. The report will provide a sound, empirical basis for any future regulatory discussions or other policy responses that could affect regulated funds and their investors. ICI’s research, legal, industry operations, and global staff are supporting the working group in drafting the report.

Previous papers in the series include