News Release

Private-Sector Retirement Plan Income Has Become More Prevalent, Not Less

ICI Study Examines Trends in Retiree Income Since 1974

Washington, DC, December 14, 2016—Retirees across all income groups are collecting more in retirement income now from employer-sponsored retirement plans than they were in the mid-1970s, when sweeping legislation reformed the operations of pension plans, according to a study released today by the Investment Company Institute (ICI).

The study, “A Look at Private-Sector Retirement Plan Income After ERISA, 2015,” finds that between 1975 and 2015 the share of retirees with private-sector pension income has nearly doubled and that the median income received by those with private-sector retirement income is up by more than 50 percent. As a result, the share of retiree income from private-sector pensions has more than doubled over this time period.

“Contrary to popular belief, private-sector pension income has become more prevalent over time, not less prevalent,” said Peter Brady, ICI senior economist and coauthor of the report. “This report refutes the myth that the period before the emergence of 401(k) plans in 1981 represented a ‘golden age’ of pension coverage and income—a belief that seems to be the basis of many retirement policy discussions.”

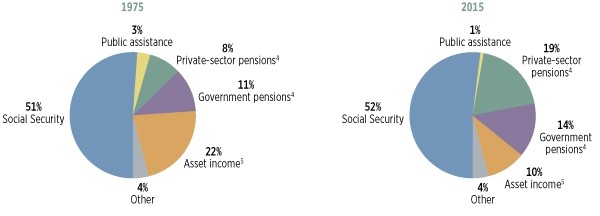

Share of Retiree Income from Pensions Has Increased over Time

Percentage of total retiree¹ income by source, on a per capita basis,² 1975 and 2015³

¹Retirees are (1) single individuals aged 65 or older who have nonzero income and who are not working or (2) married individuals aged 65 or older who have nonzero income, who are not working, and who have a nonworking spouse.

²Income of married couples is pooled and each spouse is allocated half of total household income, as well as half of household income from each source.

³See the supplemental tables (available at http://www.ici.org/info/per22-08_data.xls) for data for additional years.

⁴Both private-sector pensions and government pensions may include income from DB plans, DC plans, annuities, and IRAs. These include income from federal pensions, state and local pensions, US railroad retirement pensions, company or union pensions, IRAs, Keoghs, 401(k) plans, 403(b) accounts, annuities, and other types of retirement accounts.

⁵Asset income includes interest, dividends, and rents earned on assets held outside retirement accounts.

Note: Components may not add to 100 percent because of rounding.

Source: ICI tabulations of March Current Population Surveys

Key findings from the paper include:

Coverage by a defined benefit (DB) plan does not always result in retirement income. According to ICI’s analysis, retirees’ reliance on DB plans may be overstated if it is judged solely by pension coverage, rather than receipt of retirement plan income. Although many retirees may have worked for companies that offered DB plans at some point in their careers, the combination of vesting rules, the timing of benefit accrual, and labor mobility resulted in many retirees getting little or no retirement income from these plans, according to the paper.

For example:

- In 1975, when nearly 90 percent of private-sector pension plan participants were covered by DB plans, only 21 percent of retirees received any income—either directly or through a spouse—from private-sector pensions. Among those with private-sector retirement plan income, the median amount received per individual was about $5,000 (in constant 2015 dollars).

- In 2015, 42 percent of retirees received private-sector retirement plan income, and their median per capita amount of income increased to $7,800.

According to the paper, evidence suggests that retirement plan income continues to be underreported in the survey data used to analyze retiree income, and thus, the increase of pension income since the Employee Retirement Income Security Act of 1974 (ERISA) may be understated.

Social Security remains the largest component of retiree income and the predominant income source for lower-income retirees. In 2015, Social Security benefits represented 52 percent of total retiree income and more than 85 percent of total income for retirees in the lowest 40 percent of the income distribution. Even for retirees in the highest income quintile, Social Security benefits represented nearly 30 percent of income in 2015.

Study Explains Changes to the Survey Used to Collect Pension Income Data

ICI’s paper analyzes data on annual income from the Current Population Survey (CPS). The CPS is a monthly survey conducted by the Census Bureau for the Bureau of Labor Statistics (BLS). Every March, the BLS supplements the typical monthly survey questions with the Annual Social and Economic Supplement (ASEC). The ASEC, a special set of detailed questions on the components of income, is one of the most widely used sources for statistics on annual income.

The BLS recently revised the ASEC questionnaire in response to growing evidence that income, including pension income, was underreported in the survey. ICI’s paper also includes an appendix, which provides additional information about the changes to the survey questionnaire and the impact those changes had on the reporting of pension income.

The study was coauthored by Brady and Michael Bogdan, ICI associate economist. Supplemental tables with additional detail can be found on ICI’s website.