ICI Quarterly Update, January 2025

A New Chapter for U.S. Financial Policy

By Eric J. Pan, President and CEO

New leadership in Washington means there is an opportunity to set a future course for U.S. financial markets and retirement security. On behalf of our members, ICI is actively working with the Trump Administration and Congress to advance policies that protect fund shareholders, expand investment opportunities for all Americans, and secure the central role of funds in our retirement system.

President Trump has nominated former SEC Commissioner Paul Atkins as the next Chair of the Securities and Exchange Commission (SEC), signaling a shift toward a more pro-market and pro-innovation regulatory approach. We support this shift and believe that Atkins’ nomination, along with the naming of Mark Uyeda as Acting Chair, provides an opportunity for the SEC to take steps to modernize the investment management regulatory regime.

ICI is recommending reforms centered around four key themes:

- Fostering ETF innovation,

- Expanding retail investors’ access to private markets,

- Eliminating unnecessary regulatory costs, and

- Better leveraging the expertise of fund directors.

We believe these reforms will benefit American investors. ICI is also in discussions with the Administration and Congress about other important reforms that go beyond the SEC.

We are urging the IRS to provide administrative guidance to ease unnecessary taxes and compliance burdens that funds and their shareholders currently face. Altogether, these reforms will better align regulations with modern market realities, ensuring that funds can continue to support middle-class wealth creation.

As we engage with Congress, ICI is focused on advancing several reforms to strengthen retirement savings opportunities. First, we are urging Congress to protect the tax treatment of defined contribution (DC) plans and IRAs with the launch of our Help U.S. Retire campaign (more below). These critical tools already encourage millions of Americans to save for retirement, and targeted improvements could make them even more effective for middle-class Americans. Additionally, we are advocating for the Retirement Fairness for Charities and Educational Institutions Act, which would provide nonprofit and public-sector employees access to the same diversified investment vehicles available in 401(k)s.

We are also focused on ensuring that long-term investors are protected from harmful activist campaigns by supporting legislation to modernize the rules governing closed-end funds. To ensure stability in financial regulations, we continue to advocate for improving the Financial Stability Oversight Council’s designation process for systemically important financial institutions, which has created unnecessary burdens on nonbank entities. We are also calling for a federal standard to prevent the misuse of state unclaimed property laws, which increasingly prioritize state revenue generation over reuniting investors with their assets.

These are just some of the issues that we are discussing.

Our ability to achieve these ambitious goals is grounded in the strength of ICI’s capabilities. Through our robust policy advocacy and lobbying efforts, we will continue to ensure that our members’ voices are heard in Washington and across state capitols. Our strategic communications initiatives will help shape the conversation around critical issues affecting investors and financial markets. ICI’s industry-leading research will provide policymakers with data-driven insights that underscore the importance of our policy priorities. And our team of legal and regulatory experts will deliver rigorous analysis to support sound decision-making and effective advocacy. Together, these capabilities position ICI to advance policies that protect and empower investors.

Worth a Click

- ICI experts chart path forward on proxy voting reform

- ICI forum examines pocketbook impacts of Trump policy goals

- House Resolution recognizes the mutual fund’s 100th anniversary

- New ICI research highlights demographic and financial diversity of mutual fund investors

See You There

ICI Innovate

February 3–5

Join fellow industry professionals in beautiful Huntington Beach, CA to explore the latest trends in AI, product innovation, cybersecurity, and much more.

Investment Management Conference

March 16–19

Don’t miss the premier opportunity to engage with peers and hear directly from regulators and other experts about the issues facing asset managers. This year’s conference takes place in San Diego!

Leadership Summit

April 30–May 2

Join industry leaders in the heart of Washington, DC, for unbeatable networking opportunities and expert insights on asset management’s biggest topics, including private markets opportunities, the tax and regulatory landscape, and AI and cybersecurity considerations.

|

|

|

Supporting Members

Europe Going T+1

Even before the successful adoption of T+1 in the United States, Canada, and Mexico in May 2024, ICI has been recommending that the European Union (EU) commit to reducing trade settlement time to one day so that European markets can enjoy the benefits of faster settlement. The Financial Times published an op-ed by ICI President and CEO Eric Pan on that topic in October 2024, with Pan urging the EU to sync with the UK and Switzerland. “The move will require modernization of market infrastructure, technology and back-office operations,” Pan said, but “delay would be too costly.”

In November, the European Securities and Markets Authority (ESMA), the EU’s financial markets regulator, finally recommended an October 2027 date for the move to T+1 in Europe. ICI is ready to help support European authorities and ICI members around the world through the EU’s T+1 Industry Committee and our own T+1 UK/EU Implementation Working Group. ICI aims to facilitate a smooth and aligned transition so that European investors and markets are not left behind.

New Index/Active and ESG Research Data

ICI’s Research Department has ramped up the data available to members and the press by adding two monthly releases of long-term mutual fund and ETF distribution data—one that tracks indexed vs. active mutual funds and another that tracks products with environmental, social, and governance (ESG) components. Both data series release on the last business day of the month with data covering the previous month, with the first releases at the end of September presenting data as of the end of August. “We look forward to continuing to increase our statistical data offerings in step with the developments in the asset management industry,” said ICI Chief Economist Shelly Antoniewicz.

The new data release joins weekly, monthly, and quarterly statistical releases covering money market assets, fund flows, ETF issuance, the closed-end fund market, the US retirement market, and many more vital topics that ICI compiles in support of and in partnership with its members. Interested in receiving ICI data? Send an email to media@ici.org and ask to be added to our distribution list.

Advocating for Investment Funds

Help U.S. Retire campaign ad, currently airing on CNBC

Standing Up for the Tax Benefits of Retirement Plans

In mid-January, ICI kicked off the Help U.S. Retire advocacy campaign to protect the tax treatment of retirement accounts that middle-class Americans rely on to build their long-term financial security. As Congress considers the expiring 2017 Tax Cuts and Jobs Act, Help U.S. Retire will mobilize the 120 million American investors that use regulated investment funds and build a grassroots network to amplify their voices to Congress.

As part of our grassroots efforts to rally middle-class American investors and drive them to the Help U.S. Retire website, we launched a nationwide Help U.S. Retire ad, which began airing on CNBC on January 20. Keep an eye out for it on Squawk Box. The Help U.S. Retire campaign, which advocates for common sense tax policies, will also include social media influencer partnerships, digital content, and grasstops engagement.

The Changing Face of Fund Ownership

Mobilizing American mutual fund owners is key to the Help U.S. Retire campaign, particularly as the mutual fund investor base continues to grow. Over the past year, 2.3 million more U.S. households became mutual fund investors, according to ICI research. Alongside the rapid growth of ETFs and other products, the total number of mutual fund shareholders continues to tick up as mutual funds still dominate the retirement plan space.

ICI economists highlighted the expanding and increasingly diverse retail investor base in the U.S. in a recent ICI Viewpoints blog. The number of retail investors in mutual funds, exchange-traded funds (ETFs), and other investment products is on the rise amid a dynamic investment landscape.

Improved access to an ever-widening range of products is helping to bring new investors into the fold, empowering households of diverse backgrounds to pursue their financial goals and solidifying funds as a pillar of Americans’ finances. Read the blog and press release for more statistics and information.

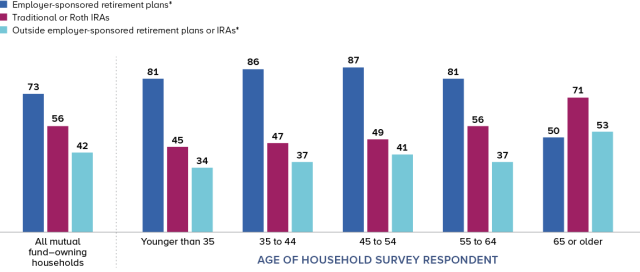

Ownership of Mutual Funds Often Through Retirement Accounts

Percentage of US households owning mutual funds by age, 2024

Source: Ownership of Mutual Funds and Shareholder Sentiment, 2024 (ICI Research Perspective)

Bolstering Support for Closed-End Funds

ICI voiced its support of the NYSE’s proposed amendments that would exempt closed-end funds (CEFs) listed on the NYSE from holding an annual meeting in a comment letter to the SEC. The letter was in response to the SEC order instituting proceedings to determine whether to approve or disapprove the NYSE’s proposed amendments. In the letter, we emphasized that the NYSE’s listing rule, which predates the 1940 Act, is unnecessary, facilitates abusive practices, and doesn’t benefit retail investors. In a supplemental blog for the Harvard Law School Forum on Corporate Governance, ICI attorneys Paul G. Cellupica and Kevin Ercoline noted that “with the annual meeting requirement eliminated, activists will find it much harder to prey on CEFs.”

The rise of shareholder activism was also a dominant theme at ICI’s last conference of 2024, the Closed-End Fund (CEF) Conference in New York City. Panelists and industry experts focused their attention on regulatory reforms for the CEF market and emerging trends. In a fireside chat, ICI President and CEO Eric J. Pan and Sullivan & Cromwell Senior Partner Dalia Blass looked ahead to the implications of a second Trump Administration on CEFs, with Blass remarking that the incoming administration would focus on “good regulation” rather than deregulation.

In the News

| “The mutual fund paved the way for other financial products including exchange-traded funds and now millions of US households own ETFs. The expanding fund market and fund shareholder base highlight that the successful innovation of investment products continues today,” said Sarah Holden, ICI Senior Director of Retirement and Investor Research. [link to article] |

| “T+1 means greater efficiency, increased liquidity and enhanced risk mitigation. As policymakers focus on strengthening capital markets, adopting T+1 has become critical for all major financial centres.” –Eric Pan, chief executive of the Investment Company Institute. [link to article] | |

| “Open-end funds have had in place sound liquidity management practices for decades, and these practices were comprehensively examined and strengthened through SEC rulemaking in 2016. By any measure, funds have managed liquidity and met redemptions successfully while pursuing their investment objectives and strategies, including in stressed conditions such as March 2020,” said a spokesperson for the ICI. [link to article] |

| “The next SEC chair has to make a hard decision as to what he or she is going to focus on. As a chair, you have bandwidth issues. So you have to be selective. You have to prioritize. There’s no Gensler rule [that] if you fail to revisit it, there’s going to be a huge problem,” said Investment Company Institute President and CEO Eric Pan. [link to article] |